Top 10 Books on Wealth Building and Financial Management

Top 10 Books on Wealth Building and Financial Management

Discover the best books to help you understand how to build wealth and manage your finances effectively. These books offer valuable insights and practical advice from renowned experts.

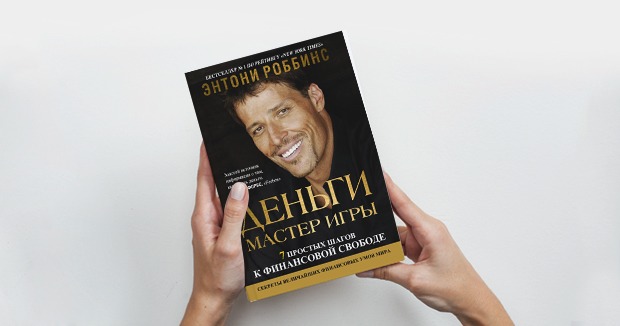

1. Tony Robbins – “MONEY Master the Game”

Tony Robbins, with a net worth of over $500 million, is one of the world’s most famous business trainers, coaches, and motivational speakers. His 7-step program to financial freedom, detailed in “MONEY Master the Game,” helps readers overcome their fears and doubts, find their own financial strategy, and build a successful business.

Robbins discusses many aspects that most of us overlook, such as the nature of money, common financial myths, financial goals, and how to achieve them. A significant portion of the book is dedicated to smart investing, which many people struggle with. The desire to invest in a profitable venture is common, but the fear of losing can be overwhelming.

While no book can provide a universal recipe for increasing your income tenfold overnight, Robbins’ book offers everything you need to start changing your life. It includes advice from financial experts, decision-making methods, and real-life inspiring stories that can motivate you towards a better future.

2. Robert and Kim Kiyosaki – “The Escape from Bad Debt”

Almost everyone has borrowed or lent money at some point. While this is normal, some people find themselves buried in debt, which can become an overwhelming part of their lives. Is there a way out?

Robert and Kim Kiyosaki suggest starting by distinguishing between good and bad debt. Good debt is when someone else pays for you, like a mortgage on a rental property. Bad debt is what you have to pay from your own pocket, such as personal loans, credit cards, and other liabilities.

In “The Escape from Bad Debt,” the authors teach readers how to benefit from their debts, choose good ones, and eliminate bad ones. Many wealthy people have more debt than poor people, but the key difference is the type of debt. For instance, in the early 1990s, Donald Trump had a personal debt of $900 million.

This book changes the perception of debt, credit, and loans regardless of your income. The main takeaway is to manage your money wisely, which leads us to the next book on our list.

3. Roman Argashokov – “Money is Always There. How to Spend Money Wisely and Have Enough for Everything”

Why does it always seem like there’s never enough money? Today, people can earn much more than they did a month ago, yet they still want more. This cycle can continue endlessly. The reason is simple: the inability to spend wisely. Most people continue to spend almost all their money on material goods and entertainment, rather than more rational and beneficial ways.

Based on his decade-long financial experience, Roman Argashokov answers the most pressing questions:

- How to manage your funds?

- How and why to insure your health and life?

- How to create a reserve for a rainy day?

- How to create a personal financial plan?

- How to beat inflation?

- How to find money right under your nose?

Practice shows that most people seriously consider rational money management only when financial problems arise. It’s much harder to get out of a critical situation than to prevent it. If you read Roman Argashokov’s book, you’ll be better prepared to avoid financial collapse in the future. Once you learn to spend money wisely on personal needs, it’s time to think about passive income, which brings us to the topic of investing.

4. Stanislav Tikhonov – “How to Invest If You Have Less Than a Million”

Many people think that investing is easy when you have tens of millions in your account. But what about people with average or below-average incomes? Can they invest to generate passive income?

Stanislav Tikhonov, the author of the “Zone of Financial Freedom” project, proves that anyone can achieve passive income. You don’t need to be a millionaire. Tikhonov divides investment tools into three levels:

- Micro-investing: high-yield investments, PAMM accounts, trading strategies

- Mid-level: life insurance, stocks, banks, real estate

- Macro-level: innovations, factories, plants, large investment projects

There are options for every income level. Moreover, you can move from one level to another or even work on two or three levels simultaneously. Smart investing requires financial literacy and the ability to save money for future investments. Our next book selection also addresses this topic.

5. Anastasia Tarasova – “Be Your Own Financial Advisor: How to Spend Wisely and Save Properly”

Did you know that in Ukraine, only half of adults maintain a personal budget? Or that only 10% of the population plans their expenses more than a month ahead? Or that nearly 80% of people rely solely on their pension in old age and don’t think about investing in their future?

Anastasia Tarasova, the author of “Be Your Own Financial Advisor: How to Spend Wisely and Save Properly,” highlights the poor state of financial literacy in the country and the post-Soviet space as a whole. More importantly, the book offers advice, rules, and recommendations on how to learn to spend and save money wisely.

After reading the book, you will learn and train yourself to:

- Record all income and expenses, plan your budget for at least a few months ahead

- Plan to optimize particularly expensive investments

- Maintain a full-fledged budget with clear financial goals

There is an old but accurate saying: “A rich person is not the one who earns more, but the one who spends less.” If not taken to extremes, this is true. Your task is to realize your financial mistakes and understand how to avoid them. The book “Be Your Own Financial Advisor” will be one of the best helpers in this matter.

6. Paul Sullivan – “The Code of the Wealthy. Live Like the Top 1% of the World’s Population”

A rich person is not distinguished from a poor one by the size of their wallet or the number of zeros in their bank account. There is another feature that cannot be measured in dollars or the number of securities: it’s their worldview.

It’s a well-known fact that people with different levels of wealth have different views on life. However, most people believe that this is a consequence. This is a fatal mistake. It’s the cause. Learn to think like a successful and rich person, and then money will not be a problem for you. Moreover, it will even seem to you that money comes to you on its own, without much effort on your part. Of course, this is not entirely true, but still.

In his book, Paul Sullivan answers the most pressing questions:

- Which investments are better than others?

- How to spend a lot but not go bankrupt?

- How to benefit from your own failures?

This work is a real code of life for successful people. It is for those who want to achieve financial independence but simply do not know where to start. Believe me, sometimes it’s enough to change your own thinking, and life will turn upside down. Today you are an ordinary office clerk, and tomorrow you are studying the cryptocurrency market and blockchain.

7. James Rickards – “Why Gold, Not Bitcoin, is the Currency of the 21st Century”

In his book, James Rickards explores the reasons why gold remains a more stable and reliable currency compared to Bitcoin. He delves into the historical context, economic principles, and market dynamics that support gold’s enduring value. Rickards provides a comprehensive analysis of why gold continues to be a trusted asset in the 21st century, making a compelling case for its superiority over cryptocurrencies like Bitcoin. For more information, you can visit James Rickards’ official website.